The Best Strategy To Use For Bathtub Replacement Fort Worth Tx

Wiki Article

Fort Worth Bathroom Remodel - The Facts

Table of ContentsThe Greatest Guide To Bathtub Refinishing Fort WorthOur Bathroom Remodel Fort Worth PDFsNot known Incorrect Statements About Bathtub Resurfacing Fort Worth Top Guidelines Of Bathroom Remodel Fort WorthThe Best Guide To Bathroom Remodeling Fort Worth

You do not need to bill tax when you do a task for a governmental company - government, State of Texas, or Texas local government. If an organization has a letter from the Financial officer of Public Accounts excusing it from sales tax obligation, and also the genuine property improvement relates to the excluded purpose of the organization, certain exemptions are readily available.When your agreement is with an excluded company, you might offer your vendors an exception certification as opposed to paying sales tax obligation on: substantial personal property that is required as well as necessary for the efficiency of the agreement as well as totally eaten (consumed or ruined after one use) at the task site; taxable services executed at the task site that are important to the efficiency of the contract; and taxable services executed at the work website that the contract requires the provider to purchase.

Charges for upkeep of genuine property are not taxable. You have to pay sales tax on all taxed things got for usage in supplying nontaxable real residential or commercial property upkeep service.

Getting The Kitchen Remodelers Fort Worth To Work

The bundled substitute or repair work components as well as materials are taxed. Genuine building maintenance might be done under either a separated or lump-sum contract (see guidelines under Accumulating Tax on New Construction). Labor that creates a manufacturing unit to make more of the very same product in a device per hr or system per year manufacturing proportion, or labor that creates a production system to make a brand-new product is called boosted capacity.

You might carry out boosted capacity tasks under either a lump-sum agreement (one price for the entire work) or under a separated contract (itemized fees for bundled materials and labor). You must refer to administrative Policy 3. 362, concerning Labor Associating with Enhanced Capability in a Manufacturing Unit in a Petrochemical Refinery or Chemical Plant, for additional information concerning the constraints to this exclusion and your tax duties when providing these services.

How Bathtub Refinishing Fort Worth can Save You Time, Stress, and Money.

The building and construction labor is not taxable. When your contract is for any of the adhering to work, you are serving as a service provider and your construction labor is not taxable: constructing brand-new structures; completing unfinished frameworks; first coating out work to the interior or exterior of a framework; structure, repairing, or remodeling homes, duplexes, houses, nursing residences, or retirement community (however not hotels); fixing actual home damaged in a location stated a natural disaster by the Head of state of the United States or the Governor of Texas when the repair work labor is independently specified from the materials - https://designfils.eba.gov.tr/blog/index.php?userid=22773.

Under a lump-sum agreement, you pay tax obligation on all your supplies, materials, devices, as well as taxed solutions when you buy them. https://www.onlinewebmarks.com/author/permaglaze01/. You don't bill your consumer tax. Under a separated contract, you offer your distributors resale certifications as opposed to paying tax obligation on materials you incorporate right into the client's genuine building and also on certain solutions, if the fees for the solutions are individually identified to the consumer.

You then accumulate state sales tax, plus any regional tax, from your customer on the amount you charge for the products and those solutions. Your cost for the products must go to least as a lot as you spent our website for them. The building and construction labor is not taxable. If you have an agreement to add new square video and also to renovate existing video in nonresidential realty for a single charge as well as the portion associating with the renovation is more than five percent of the total cost, the total fee is assumed to be taxable.

The smart Trick of Fort Worth Bathroom Remodel That Nobody is Talking About

If the cost for the taxable section of the services is not individually stated at the time of the purchase, you or your customer might later on develop for the Administrator, via documentary proof, the percent of the overall charge that associates to the brand-new construction. Instances of acceptable documents include composed agreements detailing the extent of work, quote sheets, tally sheets, timetables of values, and plans.

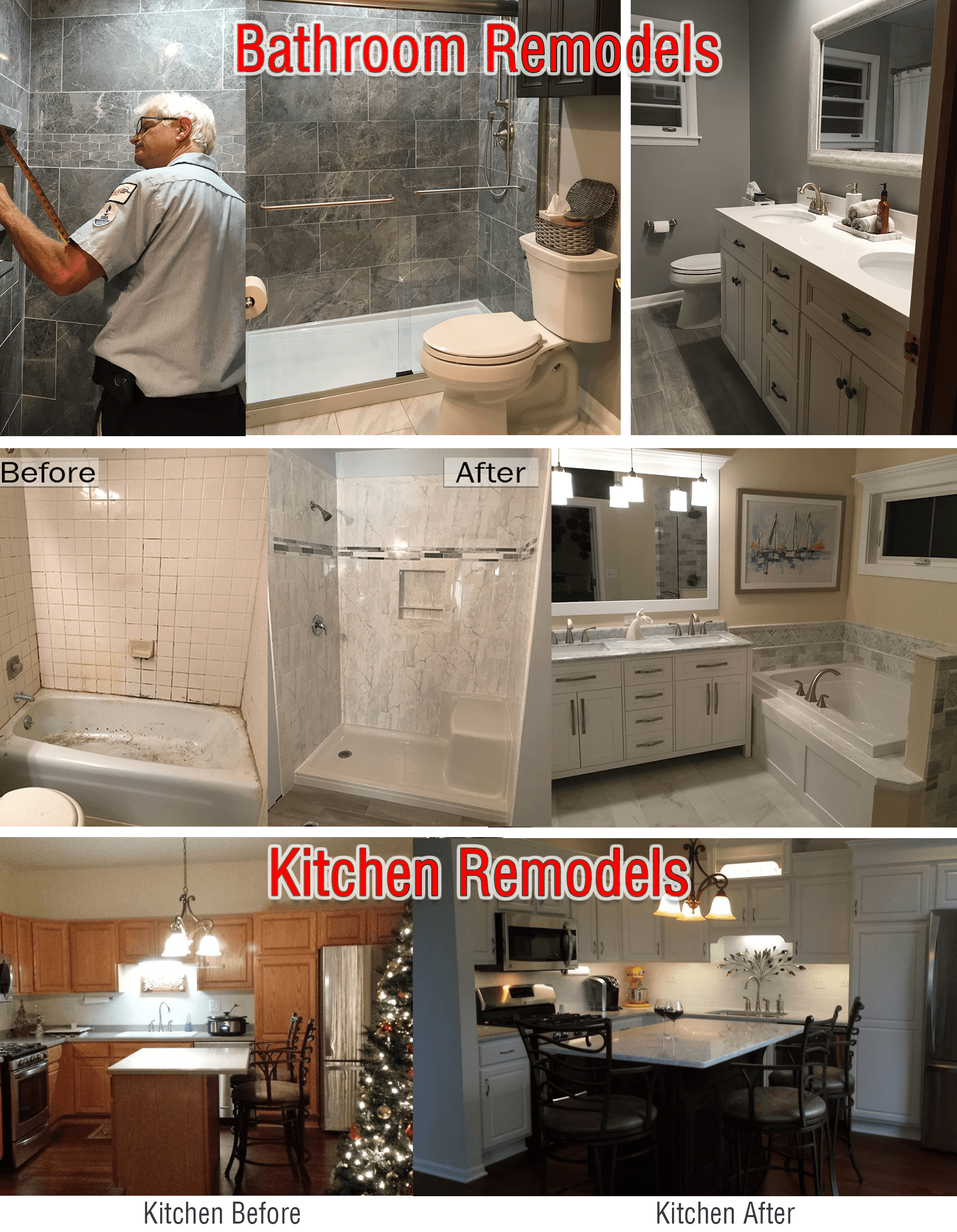

Breaths New Life Into A Room If you've begun gutting, including, or removing walls, raising ceilings, or expanding the square video of your house you have actually crossed over into renovating region. Whatever it is, remodeling breathes new life right into an area, offering the room an entire brand-new appearance as well as really feel. bathroom remodeling Fort Worth.

The 8-Minute Rule for Kitchen Remodelers Fort Worth

Unlike a basic acquisition like purchasing a cars and truck or vacuum, the price variety for a house remodel price can differ significantly because there are many aspects and also variables involved. If two neighbors remodel the precise very same area in each of their residences, it's fairly feasible one of them can conveniently invest double what the various other invests - https://www.urlvotes.com/author/permaglaze01/.When it comes to a residence remodel in Los Angeles, the complete expense can be damaged down right into four significant classifications: Labor, Products, Soft Expenses, and Service Provider Revenue (kitchen remodelers Fort Worth). First, is the 'labor' billed by the professional (https://www.wikicraigs.com/author/permaglaze01/). Although its called labor, it also includes 'rough materials' (items the professional buys like lumber, nails, drywall, etc).

Report this wiki page